Mobile apps have become an essential part of Brazilians' lives, using their smartphones to communicate, stay informed, entertained, educated, and much more. The December 2023 Mobile Time Opinion Box Panorama report provides data on app usage in Brazil, based on a survey of 2,068 Brazilians who own smartphones, with a margin of error of 2.1 percentage points.

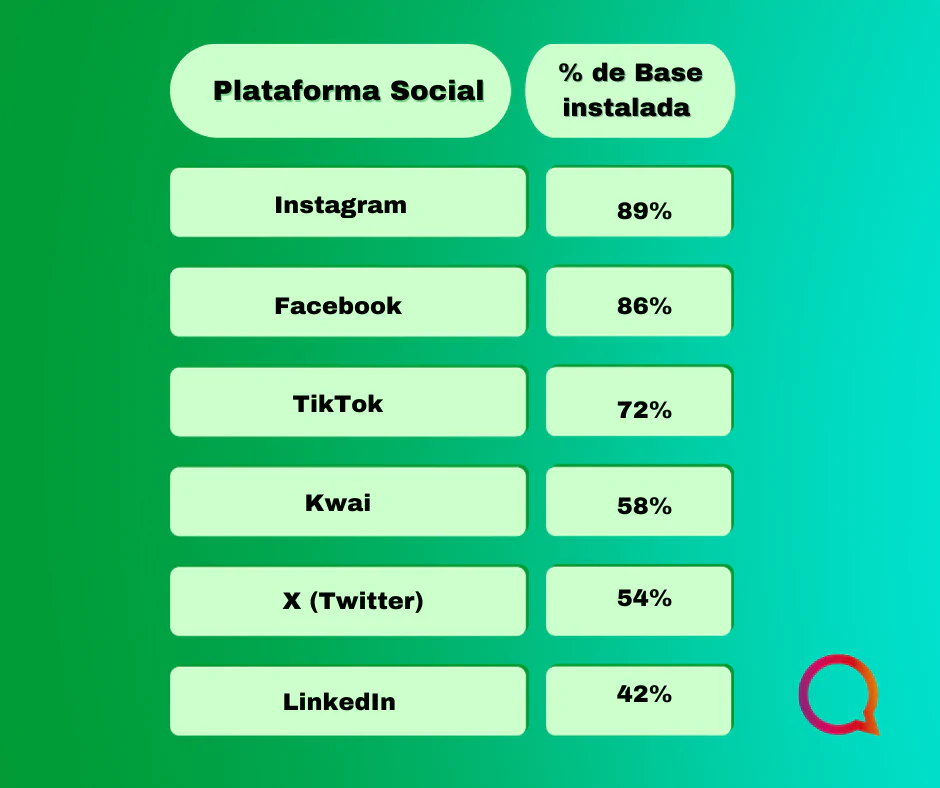

Comparison of social platforms by % installed base in Brazil

Social platforms are the most popular apps among Brazilians, who use these services to connect with friends, family, and communities. The table below shows the percentage of installed users for each social platform in Brazil—that is, the proportion of users who have the app installed on their smartphones.

Instagram leads the rankings with an installed base of 89%, followed by Facebook with 86%. TikTok, which has become a global phenomenon in recent years, ranks third with an installed base of 72%. Kwai, another short-form video app, comes in fourth with 58%, demonstrating Brazilians' preference for this type of content. Twitter and LinkedIn round out the top six with an installed base of 54% and 42%, respectively.

List of the most common applications on the home screen of Brazilian smartphones

The smartphone's home screen is the most sought-after space for apps, as it's where users have quick and easy access to their favorite services. The most common apps on the home screen of Brazilian smartphones—that is, the apps users place on their devices' first screen—are listed.

WhatsApp is the undisputed champion, with 94% of home screen presence, followed by the social networks Instagram and Facebook, with 82% and 78%, respectively. The Google Chrome browser, used by 76% of users on the home screen, ranks fourth, while YouTube, the video giant, ranks fifth with 74%. Spotify, the most popular music streaming service, is sixth with 62%. Uber, the leader in ride-hailing, ranks seventh with 58%. iFood, the country's largest food delivery service, is eighth with 56%. Nubank, the digital bank that has won over Brazilians, ranks ninth with 54%. And Netflix, the most popular movie and series streaming service, rounds out the top 10 with 52%.

List of apps most opened by Brazilians throughout the day

The apps most frequently opened by Brazilians throughout the day are those they access most frequently, whether to check notifications, send messages, see updates, or consume content. The apps most frequently opened by Brazilians throughout the day, that is, the apps users open most often in a 24-hour period.

Among the apps Brazilians access most throughout the day, WhatsApp stands out as the leader, with 37 opens per user per day. Next comes Instagram, with 29 opens, and Facebook, with 25. TikTok, the short-video sensation, is fourth, with 23 opens. YouTube, the world's largest video portal, is fifth, with 21. Gmail, the world's most popular email platform, is sixth, with 19. Google Chrome, the world's most widely used browser, comes in seventh, with 18. Twitter, the microblogging platform, is eighth, with 17. Spotify, the most popular music streaming service, ranks ninth, with 16. And Netflix, the leader in movie and series streaming, rounds out the top 10, with 15 opens.

List of apps Brazilians spend the most time on

The apps Brazilians spend the most time on are those to which users dedicate the most minutes or hours of their day, whether watching videos, listening to music, playing games, reading, studying, or doing other activities. The apps Brazilians spend the most time on are the apps users use the longest in a 24-hour period.

Brazilians love spending time on their favorite apps, but which ones consume the most attention? A list based on a national survey shows the average time users spend on each app per day, revealing their habits and preferences. The list shows that YouTube leads the audience, with 2 hours and 12 minutes per user per day. Next comes Netflix, with 1 hour and 48 minutes, and TikTok, with 1 hour and 36 minutes. Spotify, the leading music streaming app, comes in fourth, with 1 hour and 24 minutes. WhatsApp, the most used messaging app, is fifth, with 1 hour and 12 minutes. Instagram, the photo and video social network, ranks sixth, with 1 hour. Facebook, the world's largest social network, is seventh, with 48 minutes. Kwai, another short-video app, comes in eighth, with 36 minutes. GloboPlay, the streaming service of Brazil's leading TV network, is ninth, with 24 minutes. And Disney+, the streaming service of the powerful entertainment company, rounds out the top 10, with 12 minutes.

Monitoring the market for movie and series streaming applications

Movie and TV streaming apps are services that allow users to watch audiovisual content on demand, through a monthly or annual subscription. See the ranking of the top movie and TV streaming apps in Brazil that users subscribe to:

Netflix leads the movie and series streaming app market in Brazil, with a 62% share. Disney+ comes in second, with a 18% share. Amazon Prime Video comes in third, with a 12% share. GloboPlay comes in fourth, with a 6% share. And HBO Max comes in fifth, with a 2% share.

Music App Market Monitoring

Music apps are services that allow users to listen to music on demand, through a monthly or annual subscription, or for free with ads.

Spotify leads the music app market in Brazil, with a 42% share. YouTube Music comes in second, with a 28% share. Deezer comes in third, with a 16% share. The Le Music app comes in fourth, with an 8% share. And Tidal comes in fifth, with a 6% share.

Monitoring the mobile gaming market

Mobile games are applications that allow users to play games on their smartphones, either for free, with ads or in-app purchases, or for a fee, with a fixed price or subscription.

Free Fire is the mobile game that generates the most revenue in Brazil, with 38% of the total revenue. PUBG Mobile comes in second, with 22% of the total revenue. Candy Crush Saga comes in third, with 12% of the total revenue. Clash of Clans comes in fourth, with 8% of the total revenue. And Among Us comes in fifth, with 6% of the total revenue.

Monitoring sports betting apps

Sports betting apps are services that allow users to bet on sporting events, such as soccer, basketball, tennis, etc., through an online platform. Number of monthly active users of the main sports betting apps in Brazil, that is, the number of users who access each app at least once a month.

Bet365 is the most popular sports betting app in Brazil, with 4.2 million monthly active users. Sportingbet comes in second, with 3.6 million monthly active users. Betfair comes in third, with 2.8 million monthly active users. 1xBet comes in fourth, with 2.4 million monthly active users. And Betway comes in fifth, with 2 million monthly active users.

Proportion of Brazilians who have read books on their smartphones

Digital books are book formats that can be read on electronic devices, such as smartphones, tablets, e-readers, etc. The table below shows the proportion of Brazilians who have already read books on their smartphones, that is, the percentage of users who have already used their smartphones to read digital books.

The proportion of Brazilians who have read books on their smartphones has been increasing in recent years, rising from 28% in 2019 to 44% in 2023. This shows that smartphones have become a convenient and accessible alternative for readers, who can enjoy the benefits of digital books, such as ease of purchase, unlimited storage, portability, and interactivity.

Proportion of Brazilians who subscribe to newspaper and magazine reading services on smartphones

Newspaper and magazine reading services on smartphones are applications that allow users to access journalistic and editorial content from various media outlets through a monthly or annual subscription. The table below shows the proportion of Brazilians who subscribe to newspaper and magazine reading services on smartphones, that is, the percentage of users who pay for this type of service.

The proportion of Brazilians who subscribe to newspaper and magazine reading services on their smartphones has been growing in recent years, rising from 12% in 2019 to 28% in 2023. This shows that Brazilians are increasingly interested in staying informed and up to date on world events, and that reading services offer a practical and economical way to access diverse, quality content.

Proportion of Brazilians who took courses through a smartphone app

Smartphone app courses are learning programs that can be completed on mobile devices, such as smartphones, tablets, etc., through applications that offer educational content in various formats, such as videos, audio, texts, etc. The table below shows the proportion of Brazilians who have taken courses through smartphone apps, that is, the percentage of users who have used their smartphones to take some type of course.

The proportion of Brazilians who took courses through smartphone apps has been increasing in recent years, rising from 18% in 2019 to 42% in 2023. This shows that Brazilians are increasingly seeking to qualify and improve themselves in various areas, and that app-based courses offer a flexible and convenient way to learn new skills and knowledge.

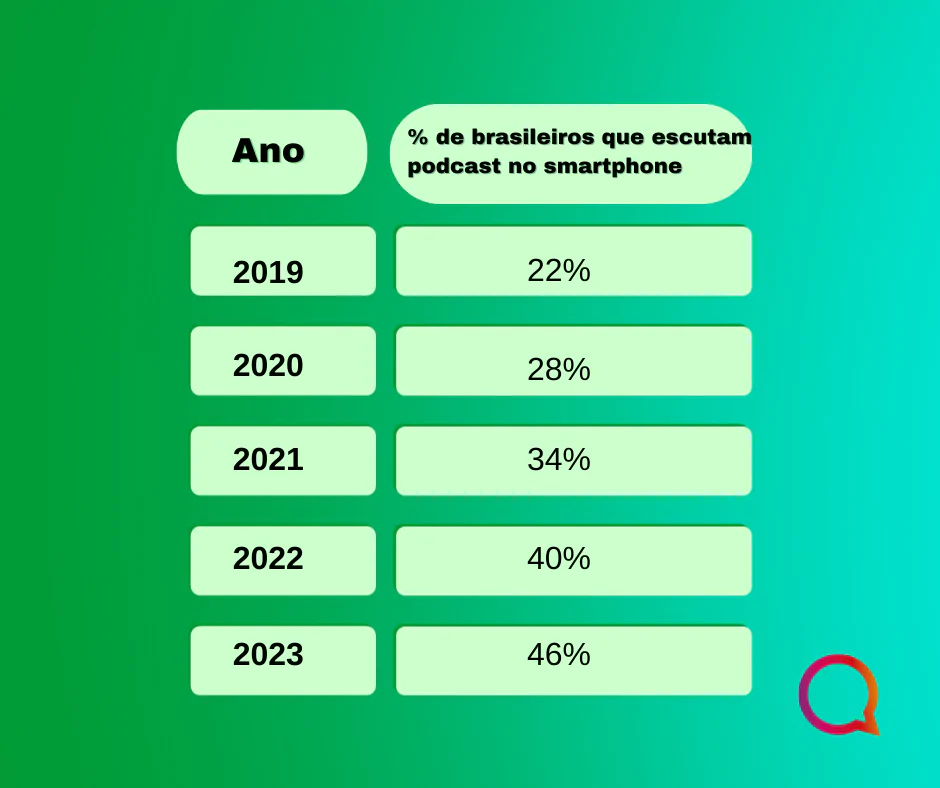

Proportion of Brazilians who listen to podcasts on their smartphones

Podcasts are audio content that can be listened to on electronic devices such as smartphones, tablets, computers, etc., through apps that allow you to download or stream episodes. Podcasts cover a variety of topics, such as news, entertainment, culture, education, etc. The table below shows the proportion of Brazilians who listen to podcasts on their smartphones—that is, the percentage of users who have used their smartphones to listen to podcasts.

The proportion of Brazilians who listen to podcasts on their smartphones has been growing in recent years, rising from 22% in 2019 to 46% in 2023. This shows that Brazilians are increasingly interested in consuming audio content, which offers a dynamic and engaging way to stay informed, entertained, and educated.

Monitoring the video calling application market

Video calling apps are services that allow users to make video calls with others, either individually or in groups, via an internet connection. Video calling apps are used for a variety of purposes, including work, study, leisure, and more.

Zoom is the most downloaded video calling app in Brazil, with 12 million downloads in 2023. WhatsApp comes in second, with 10 million downloads in 2023. Google Meet comes in third, with 8 million downloads in 2023. Skype comes in fourth, with 6 million downloads in 2023. And Facebook Messenger comes in fifth, with 4 million downloads in 2023.

This data reveals the trends and habits of Brazilians regarding the use of applications on their smartphones, and can serve as a basis for the development of new services, products and strategies for the mobile market in Brazil.

Source: Mobile Time Opinion Box Panorama Report – December 2023.